This is a very basic overview of Inheritance and Intestacy for somebody who died in England or Wales without leaving a valid will.

N.B. This changed from the old rules on 1st October 2014 due to the The Inheritance and Trustees Powers Act 2014 (ITPA 2014)

This website is NOT intended to be a definitive statement of the law covering every set of circumstances, nor is it legal advice.

|

Deceased still married or in a civil partnership, AND survived by these relatives: |

After the payment of funeral expenses, tax and all other debts owed by the deceased, the rest of the estate goes to: |

|---|---|

|

A spouse OR civil partner |

Everything to spouse / civil partner |

|

A Spouse OR Civil Partner Excluding a child of the deceased adopted by another person (unless the adoption occurred after the death) |

i). Where the net estate is not more than £ 322,000 - Everything to spouse / civil partner If a child has died before the intestate, their children will inherit in their place, each equally sharing their parent's entitlement |

|

Step-children, OR foster children, OR a child of the deceased adopted by another person (unless the adoption occurred after the death) |

Get NOTHING |

|

A Common-Law Spouse OR Cohabiting Partner |

The surviving common-law spouse or cohabiting partner gets NOTHING |

|

If there is NO surviving spouce, OR the deceased was NOT married NOR in a civil partnership AT the time of their DEATH, but survived by these relatives: |

After the payment of funeral expenses, tax and all other debts owed by the deceased, the rest of the estate goes to: |

|---|---|

|

A common-law spouse or cohabiting partner |

The surviving common-law spouse or cohabiting partner gets NOTHING |

|

Children (including legitimate, illegitimate or legitimated children, as well as children adopted by the deceased) |

Everything to the children (or if any predecease the intestate their own children will inherit in their place, equally sharing their parent's entitlement) in equal shares If a child has died before the intestate, their children will inherit in their place, each equally sharing their parent's entitlement |

|

Step-children, OR foster children, OR a child of the deceased adopted by another person (unless the adoption occurred after the death) |

Get NOTHING |

|

Parent(s), but no children |

Everything to the parents in equal shares. |

|

Brother(s) or sister(s), but no children or parents |

Everything to brothers and sisters of the whole blood (or if any predecease the intestate their own children will inherit in their place, equally sharing their parent's entitlement) in equal shares If there are no brothers or sisters of the whole blood, then to brothers and sisters of the half blood equally |

|

Grandparent(s), but no children, or parents, or brothers or sisters |

Everything to grandparents equally. |

|

Uncle(s), Aunt(s), but no children or parents, or brothers or sisters or grandparents |

Everything to uncles and aunts of the whole blood (or if any predecease the intestate their own children will inherit in their place, equally sharing their parent's entitlement) in equal shares If there are no uncles or aunts of the whole blood, then to uncles or aunts of the half blood equally. |

|

No relatives in any of the categories shown above |

Everything to the Crown |

The inheritance and intestacy rules above mean that if you don't write a valid will some of your relatives might inherit some of your estate, but not necessarily in the proportions that you wanted them to receive it.

It should also be very clear that if you are "NOT married", but just "living with" your "common-law spouse" or "partner", that THEY WILL NOT INHERT ANYTHING AT ALL FROM YOU, unless you leave a Valid Will.

So to make sure that you're loved ones receive all that you want them to get please

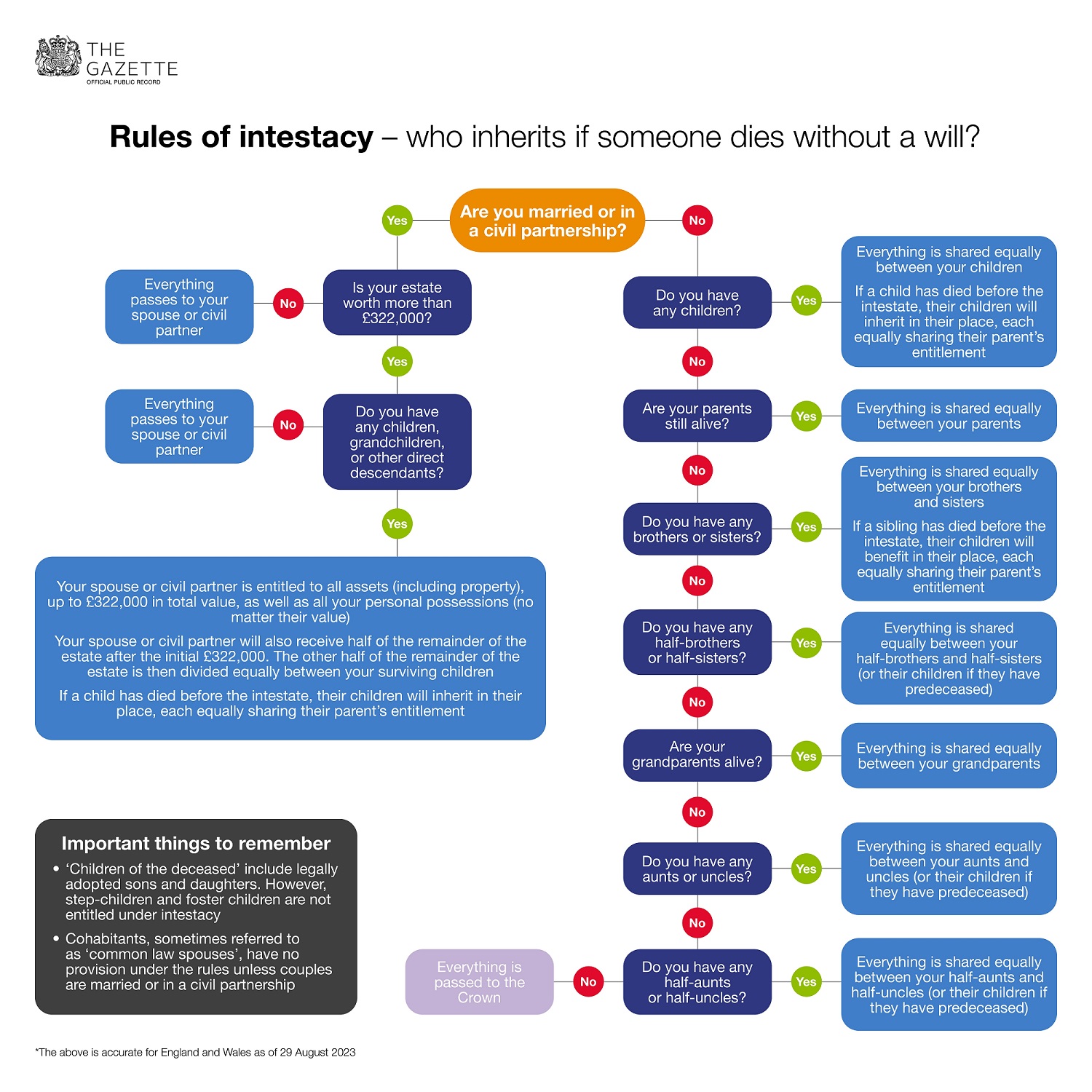

The image above is from The Gazette, www.thegazette.co.uk

Words used in everyday language, often have different meanings in the legal sense. The following explanations are intended as a guide rather than strict legal definitions of the words used in this document

- A spouse is a person who was legally married to the deceased when he / she died.

- A civil partner is someone who was in a registered civil partnership with the deceased when he or she died. It does not include people simply living together as unmarried partners or as ‘common law husband and wife’.

- The term children includes children born in or out of wedlock and legally adopted children; it also includes adult sons and daughters. It does not, however, include step-children.

- Brothers and sisters of the whole blood have the same mother and father. Brothers and sisters of the half blood (more commonly referred to as “half-brothers” or “half-sisters”) have just one parent in common.

- Uncles and aunts of the whole blood are brothers and sisters of the whole blood of the deceased’s father or mother.

If any of the deceased’s children die before him or her, and leave children of their own, (that is grandchildren of the deceased), then those grandchildren between them take the share that their mother or father would have taken if he or she had still been alive. This also applies to brothers and sisters, and uncles and aunts of the deceased who have children - if any of them dies before the deceased, the share that he or she would have had if he or she were still alive, goes to his or her children between them.

The principle applies through successive generations – for example, a great grandchild will take a share of the estate if his father and his grandfather (who were respectively the grandson and son of the deceased) both died before the deceased.

A spouse or civil partner must out-live the deceased by 28 days before they become entitled to any share of the estate.

An ex-wife or ex-husband or ex-civil partner (who was legally divorced from the deceased or whose civil partnership with the deceased was dissolved before the date of death), gets nothing from the estate under the rules of intestacy, but he / she may be able to make a claim under the Inheritance (Provision for Family and Dependants) Act 1975. through the Courts.

Anyone who is under 18, (except a spouse or civil partner of the deceased), does not get his or her share of the estate until he or she becomes 18, or marries under that age. It must be held on trust for him or her until he or she becomes 18 or gets married.

Apart from the spouse or civil partner of the deceased, only blood relatives, and those related by legal adoption, are entitled to share in the estate. Anyone else who is related only through marriage and not by blood (for example, a step-brother or step-sister) is not entitled to share in the estate.

If anyone who is entitled to a share of the estate dies after the deceased but before the estate is distributed, his or her share forms part of his or her own estate and is distributed under the terms of his or her own will or intestacy.

Great uncles and great aunts of the deceased (that is brothers and sisters of his or her grandparents) and their children are not entitled to share in the estate.